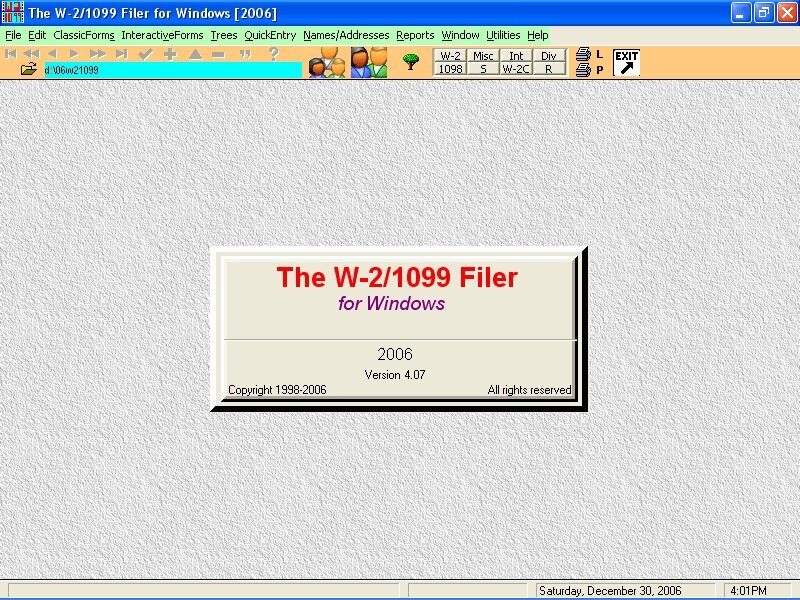

The next generation tax payers are more into the w2 software at etc.com for the high-end features and convenience the technology offers. This is a complete database system that supports to generate all types of 1099 and W2 forms. Such software are form generators and filer as well and supports the payers with the easy-to-access interface, menu-driven formats and so on.

Within a short while from inception, the software technology has been largely accepted by the taxpayers. Most of the top graded W2 software technologies are powered by the printing technology, data importing feasibility, electronic filing –e-filing through IRS FIRE and SSA Business Online, backup and data restoring capability, and more. Apart from all these features, the W2 filing software is completely secured.

How the W2 Software revolutionized the whole form filing process with the sought after features; take a look—

Few highlights of the software system

- The technology supports all the forms including all 1099 forms, W-3 and W-2 forms.

- Extremely well-maintained database where the payer’s information needed to be enter once.

- W2 software supports nearly 90,000-99,999 employees/payer.

- It’s easy to fill up the form as it looks similar to the tangible forms

- If any wrong data is entered, you can always edit it.

- Easily get the information of payees through individual files without putting the data multiple times.

- Enter and import the data from any source including Excel, usual text files, print files etc.

- Meets the IRS and the regulations of social security.

- Password protected and 100% secured.

- Confirmed data validation.

- Create 1099 and W2, W2 PDF forms in quickly.

- Great tech-support solutions for the US customers.

- Quick and error free tax analysis and calculations.

- Great backup of the previous data even after the new ones are stored.

- Cost-effective as you hardly need a tax consultant.

- Affordable as found in various ranges and services.

If you install serious W2 software, it can surely handle to store records and will manage the employee information with the new batches and will delete the old ones but only by keeping the backup that you might need anytime.

The software knows to update the W2 forms according to the promotion or increase of the pay bands of the employees, so that during tax filing, you don’t have to rummage the old files and fix it.

So, why should get going with the manual stuff when the next generation W2 software technology is in your hands?